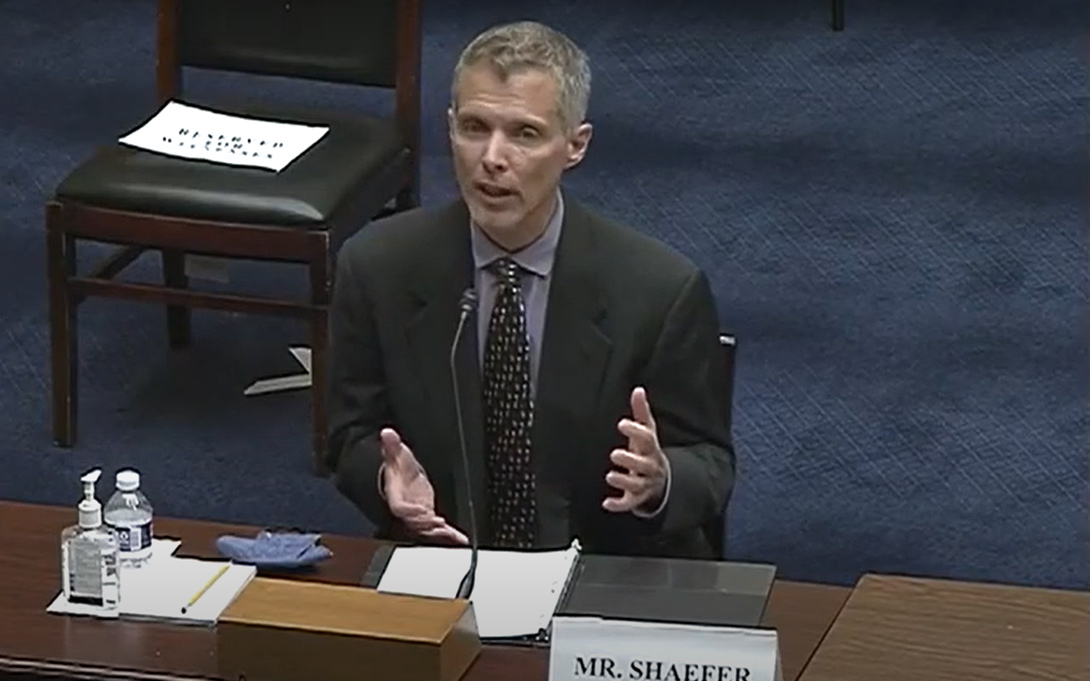

On September 22, Luke Shaefer, the Hermann and Amalie Kohn Professor of Social Justice and Social Policy, testified before the U.S. House Select Subcommittee on the Coronavirus Crisis. The hearing also included four other invited experts to speak about the economic hardships experienced by families and the effect of pandemic responses.

To begin his testimony, Shaefer reflected on concern he had in early March 2020 for low- and middle-income Americans, especially those families with children, living paycheck to paycheck. He said, “Looking back today, there is no question that this has been a time of trial for American families. Yet it has also proven to be a time when the government worked, when public policy shielded millions of families from economic crisis like we have never done before.”

Shaefer highlighted research that showed the action taken by Congress led to “impacts in the PULSE data, clear as day.” He said, “From December 2020 to April 2021, food insufficiency plummeted by over 41%, financial instability fell by 45%, and reported adverse mental health symptoms fell by 20%. Hardship has started to inch up in recent months as we get further away from Economic Impact Payments, but even now, food hardship and financial instability remain well below levels seen in December 2020.”

He said it is critical to recognize the successes we have had. “This is the best, most successful response to an economic crisis that we have ever mounted, and it is not even close. I hope we can continue the bipartisan blueprint forward.”

Shaefer concludes in his written testimony with a call for Congress to make the expansion of the child tax credit permanent.

“The expanded child tax credit is as simple as it is transformative in that it treats all low- and middle-income children the same. It says that raising kids is expensive and society has a reason to come alongside parents in that work. Research indicates that we will benefit from this investment in our children for years to come. We are at a crossroads and you have the power to chart a very different path forward.”

You can watch the hearing here.