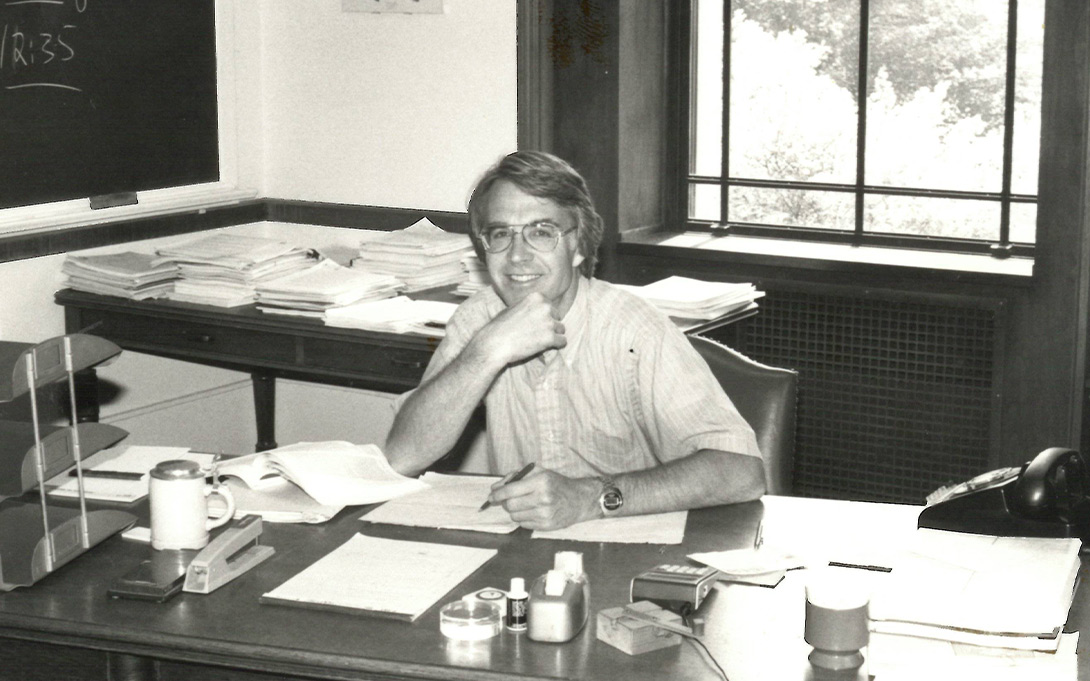

The Gerald R. Ford School has long served at the forefront of a nexus of policy debates in the effort to raise the next generation of policymakers. Synonymous with the Ford School’s distinguished history is the late Edward “Ned” Gramlich—longtime public policy professor, twice director of U-M’s Institute of Public Policy Studies (IPPS), and the first dean when IPPS became the School of Public Policy.

When Ned came to the University of Michigan in 1976, he already had had a distinguished, diverse career with the Federal Reserve—for which he would later serve on the Board—and the Office of Economic Opportunity.

As a former Governor for the Fed, the Federal Reserve Board Oral History Project conducted an interview with Ned on August 8, 2007, shortly before he passed away. The interview focuses on Ned’s contributions at the Fed—both his initial stint in the 1960s and his time on the Board three decades late—and his opinions on the what was, at the time of his interview, the beginning of the Great Recession.

One passage from the interview on Ned’s appointment to the Board of the Fed offers a glimpse into not only the high demand for his knowledge and experience, but also his good-natured and humorous spirit.

After acting as dean of the School of Public Policy for a few years, Ned received a phone call. On the other end, Alicia H. Munnel from the Council of Economic Advisors simply asked, “Would you like to be on the Fed?” to which Ned responded “Sure.” And that was it Ned, according to Ned.

When pressed further on the process Ned recalled “I met Gene B. Sperling, who was the President’s person and also from Ann Arbor. All we ever talked about was Michigan football. And that was it. I could have been a raving Communist, and nobody would have discovered it.”

The interview, while occasionally perforated with such amusing anecdotes, also focused on Ned’s significant contributions while at the Fed. During the interview, Ned brought up just how he and his colleagues attempted to uncover racial bias regarding the issuance of high-priced loans. When he initially embarked upon this work, Ned said, “There was never really much controversy in the adoption of it.” Mostly because the banks, Ned remembered, did not believe the Fed would implement such a policy.

Thanks to Ned’s work in this area he and his colleagues exposed “something like 200 banks out there with pretty dramatic racial disparities in the incidence of high-priced loans.”

Ned's full interview, along with countless other notable names, is available as part of the history section of the Federal Reserve Board's website.