As the Biden administration embarks on its first hundred days, experts from the Gerald R. Ford School of Public Policy have produced a series of policy briefs on key issues. Download the PDF of this brief or read the web-formatted version below.

By Natasha Pilkauskas, Assistant Professor of Public Policy, University of Michigan, and Katherine Michelmore, Assistant Professor of Public Administration and International Affairs, Syracuse University

Congress recently passed the American Rescue Plan. Although many of the plan’s important features have gotten a lot of attention—the stimulus check, the child tax credit, the (now removed) minimum wage increase—one aspect of the plan, an increased Earned Income Tax Credit (EITC) for childless workers, has gotten little attention. Yet for 17 million Americans this little discussed policy change could mean more economic relief.¹

What does the new policy do?

Currently, adults who work and earn less than $15,820 a year and have no qualifying children (a child who lives with them at least half of the year) can get a maximum EITC of $530. The new plan extends the maximum income limit to about $21,000 ($27,110 if married) and increases the maximum credit to $1500. The House bill also expands the EITC to include working young adults (ages 19-24) who are not students, normally excluded from the childless EITC. Lastly, the bill removes the maximum age limit for claiming the EITC, which is currently 65. The bill also extends the EITC to include residents of Puerto Rico and American Samoa.

The expanded EITC will reduce and relieve poverty of many working American adults – a group excluded from many other social policies.

- Expanded reach. The bill increases the number of EITC-eligible adults without qualifying dependents by 17 million—and the 8 million adults who already get the credit will be helped more too.²

- Fewer people taxed into poverty. The bill will dramatically reduce the number of workers taxed into poverty (currently about 5.8 million workers).³

- Positive effects on work, income, and households. Research shows that the EITC reduces poverty, increases work and income, and has many other positive effects on families with children.⁴ There are reasons to expect similar positive effects on childless adults.

- Helping kids too. Although this policy is referred to as the “childless EITC”, it does not mean that these adults do not have children—rather, their child might not live primarily with them. Previous studies have shown that increasing tax credits to non-custodial parents boosts child support payments, suggesting a spillover benefit to households with children.⁵

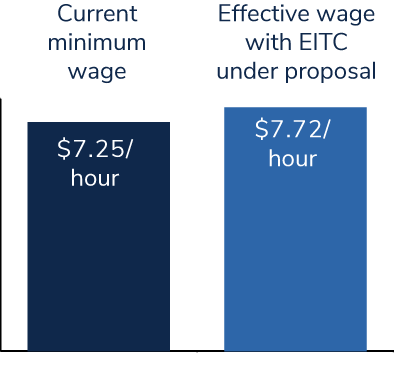

An unmarried, childless 25-year old working full-time, full-year, at the federal minimum wage ($7.25), would earn about $15,000 a year, and would be eligible for an EITC worth $57 under the current law. Under the new proposal, this individual would receive about $980, raising their effective wage to $7.72 an hour.

How might we make a good policy even better?

- Expand the benefit to students. The current proposal excludes adult students under 24, despite the fact that most students work at least part-time, more than half of students report being financially independent from their parents, and many experience material hardship and food insecurity.⁶ An easy fix would be to only allow one person to claim the student as dependents – either the student or their parents.

- Implement efforts to increase claiming among low-income populations. Only two-thirds of eligible childless tax filers claim the EITC, as many are not required to file taxes.⁷ Efforts to increase filing have mixed success, but recent work found letters and free tax preparation increased filing.⁸ Increasing tax filing among low-income populations will be key to the success of the expanded EITC program.

Citations

- https://www.cbpp.org/research/federal-tax/house-ways-and-means-covid-re…;

- https://www.urban.org/urban-wire/expanding-earned-income-tax-credit-cou…

- https://www.cbpp.org/research/federal-tax/house-ways-and-means-covid-re…

- Hoynes, H. W., & Patel, A. J. (2018). Effective policy for reducing poverty and inequality? The EITC and the distribution of income. Journal of Human Resources, 53(4), 859-890.

Pilkauskas, N., & Michelmore, K. (2019). The effect of the EITC on housing and living arrangements. Demography, 56(4), 1303-1326.

Bastian, J., & Michelmore, K. (2018). The long-term impact of the EITC on children’s education and employment outcomes. Journal of Labor Economics, 36(4), 1127-1163. - https://www.mdrc.org/sites/default/files/PaycheckPlus_FinalReport_0.pdf

- https://www.gao.gov/assets/700/696254.pdf

- Jones, M. 2014. Changes in EITC eligibility and participation, 2005-2009. CARRA Working Paper Series.

- Goldin, J. et al. (2021). Tax Filing and Take-Up: Experimental Evidence on Tax Preparation Outreach and EITC Participation. National Bureau of Economic Research.